Turkish carriers launch VSA with joint service wooing Red Sea volumes

Turkish container carriers Turkon Line and Arkas Line seem to have scooped up significant India-Mediterranean ...

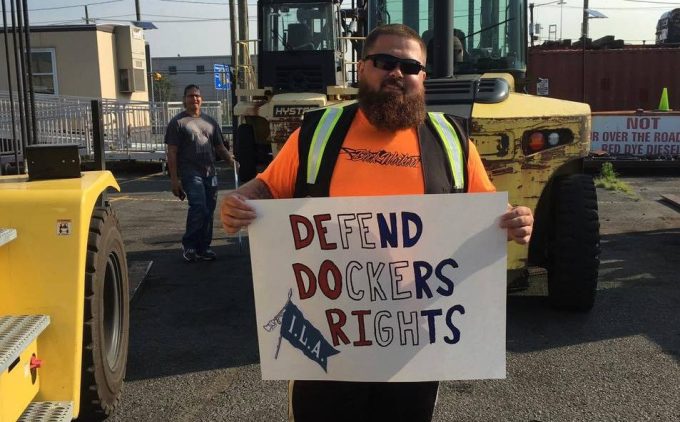

With each week that passes, the risk of a US east and Gulf coast dock strike is heightened; but ILA president Harold Daggett’s pledge that his union members will “hit the streets” on 1 October could be a silver lining for ocean carriers.

Carriers privately admit that supply chain disruption from that strike could be the antidote to a rates collapse in the final quarter of the year.

Container spot rates from Asia to the US ...

'Disastrous' DSV-Schenker merger would 'disrupt European haulage market'

New senior management for DSV as it readies for DB Schenker takeover

Volumes set to 'fall off a cliff' as US firms hit the brakes on sourcing and bookings

Asian exporters scramble for ships and boxes to beat 90-day tariff pause

Amazon pushes into LTL for small package fulfilment and UPS does a u-turn

Temporary tariff relief brings on early transpacific peak season

Pre-tariff rush of goods from US to China sees air rates soar, but not for long

Forwarders 'allowing the fox into the chicken run' by supporting 'hungry' carriers

Comment on this article