Spot rates on transpacific surge after news of tariff time-out

Container freight spot rates shot up on the transpacific trades this week, with an immediate ...

High capacity and low demand will leave ocean carriers on Asia-North Europe routes in a tight spot, with analysts suggesting even mild growth would seem a major victory.

Drewry said that, with demand remaining low, carriers were likely set to face the same challenges as last ...

Bad news for shippers as wave of transpacific rate increases continues

No deals with carriers, say Houthis – Red Sea safe for non Israel-affiliated ships

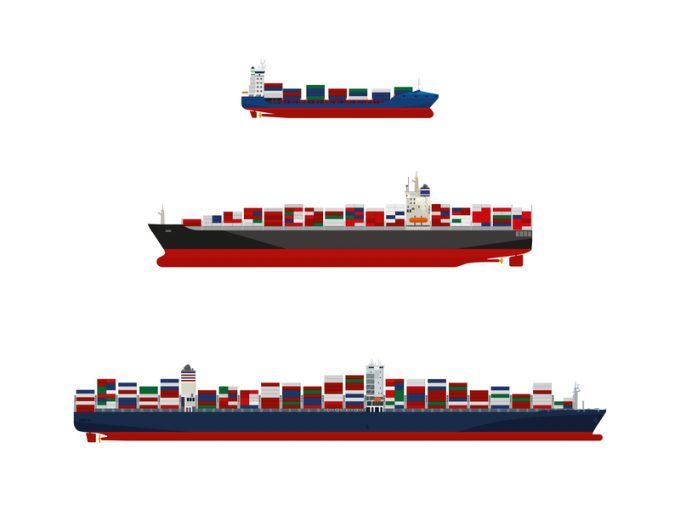

Rapid transpacific capacity build-up continues – can USWC ports handle it?

Schenker's Shirley Sharma Paterson moves to K+N as global head of sales

Red Sea crisis has driven most new capacity into extended Asia-Europe trades

Carriers on the hunt for open tonnage again as transpacific rates soar

Dates to watch for in the latest chapter of TACO's tariff travail

Freighter capacity on the rise, with air cargo demand expected to pick up

Comment on this article