US CBP sees 90% fall in revenue last month; airfreight sees ecomm slide

February may have been the month in which the US suspended its de minimis exemption ...

Air freight rates have sunk to mid-March levels, while jet fuel prices rose 7% last week, putting more doubt on the viability and demand for cargo-only passenger aircraft services.

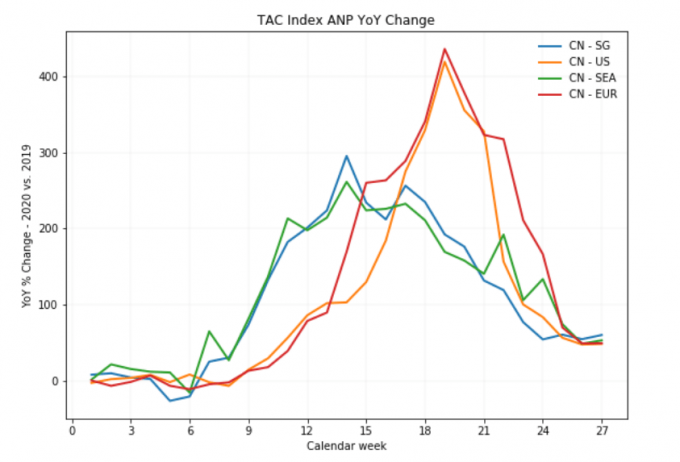

The TAC index this morning shows air freight rates out of China, to both Europe and the US, sank nearly 10% in the week ending yesterday. But the biggest drops were out of Hong Kong, where prices fell 16% to the US, to $4.29, and 15% to Europe ($3.25).

The charts reveal air ...

Asia-USEC shippers to lose 42% capacity in a surge of blanked sailings

USTR fees will lead to 'complete destabilisation' of container shipping alliances

Outlook for container shipping 'more uncertain now than at the onset of Covid'

New USTR port fees threaten shipping and global supply chains, says Cosco

Transpac container service closures mount

DHL Express suspends non-de minimis B2C parcels to US consumers

Zim ordered to pay Samsung $3.7m for 'wrongful' D&D charges

Flexport lawsuit an 'undifferentiated mass of gibberish', claims Freightmate

Comment on this article