Hyundai deploys fire-fighting tech to combat risk from lithium batteries

Hyundai Glovis has designed a device for its car-carrier fleet to suppress fires that break ...

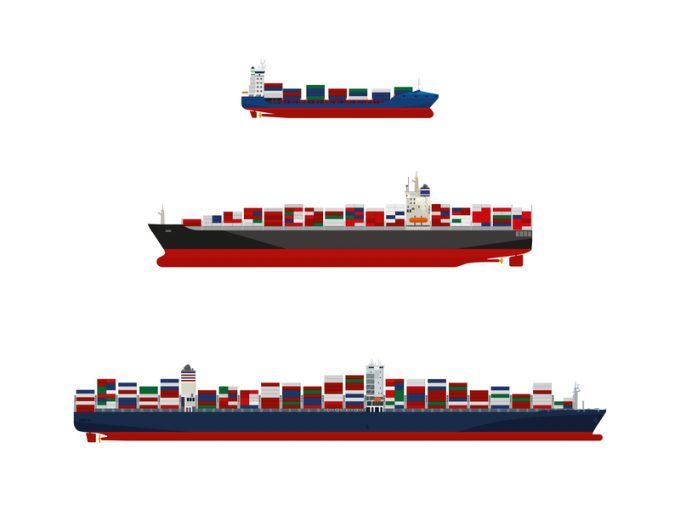

It seems the ultra-large container vessels (ULCVs) that have become the ‘new normal’ on the Asia-Europe tradelane have not proved as popular as the lines that operate them hoped.

Several shippers The Loadstar spoke to at Transport Logistic in Munich last week could not hide their aversion to the ...

Bad news for shippers as wave of transpacific rate increases continues

No deals with carriers, say Houthis – Red Sea safe for non Israel-affiliated ships

Rapid transpacific capacity build-up continues – can USWC ports handle it?

Schenker's Shirley Sharma Paterson moves to K+N as global head of sales

Red Sea crisis has driven most new capacity into extended Asia-Europe trades

Carriers on the hunt for open tonnage again as transpacific rates soar

Dates to watch for in the latest chapter of TACO's tariff travail

Freighter capacity on the rise, with air cargo demand expected to pick up

Comment on this article

KEVIN MONTEATH

June 10, 2019 at 8:46 pmBigger vessels by lines will not only take away the profits,But will dig the grave bigger.

Bigger vessels will create a bad impact on the bottom line, Unless this stops, liner investors will face major hurdles and setbacks. 12000-15000 Teus is the game plan and win win situation. Joint service and trust by lines must be adhered on vessel sharing agreements. its a MUST

Where is the cargo? who gets a bigger slice by implementing ULCVS? Will it create a trade war in on all trade lanes? These are the consequences liner companies have to ask themselves, Survival long term or short term is the call now. my views kevin monteath-canada