East-west rates diverge as transpac spots hold while Asia-Europe keeps falling

Container spot freight rates on the main east-west trades diverged this week after a series ...

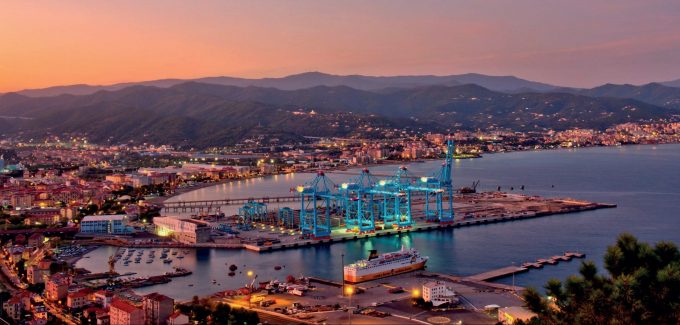

Maersk is launching a feeder service between its east Mediterranean transhipment hub of Port Said and the Italian gateway of Vado Ligure to reduce Asian import transit times for central European shippers.

The company said the service, deploying two 3,000 teu vessels, would help avoid some of the congestion issues faced at Europe’s major container gateways.

“In an increasingly unpredictable environment, our customers ask for more reliable and agile supply chains – and this is exactly what the new Vado Express service ...

Outlook for container shipping 'more uncertain now than at the onset of Covid'

Transpac container service closures mount

Zim ordered to pay Samsung $3.7m for 'wrongful' D&D charges

Flexport lawsuit an 'undifferentiated mass of gibberish', claims Freightmate

Shippers warned: don't under-value US exports to avoid tariffs – 'CBP will catch you'

Cancelled voyages take the sting out of spot rate declines this week

New Houthi warning to shipping as rebel group targets specific companies

Blanked sailings in response to falling demand 'just a stop-gap solution'

Comment on this article