Maersk warns of delays in Rotterdam after port workers' strike

Maersk has advised that, following a strike at Hutchison Port Delta II in Rotterdam on ...

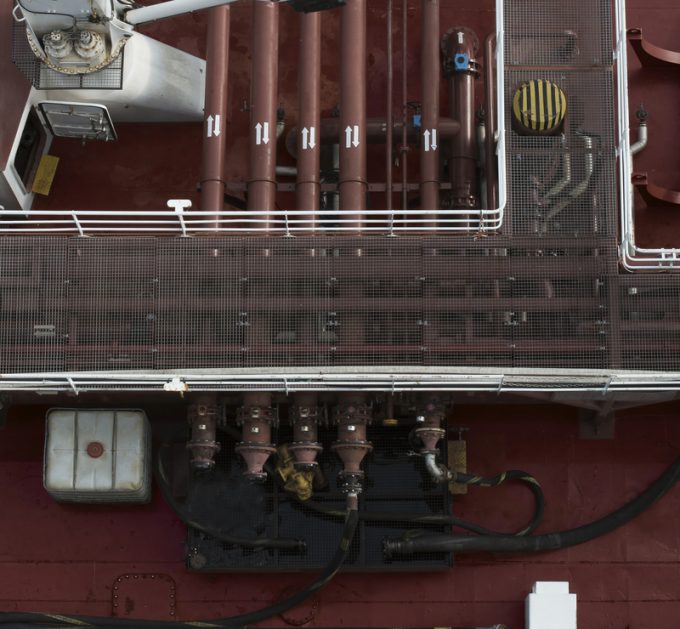

Carriers and shippers remain in dispute over who will pay for compliance with the pending sulphur fuel cap.

And they have further concerns over unified global enforcement.

At the European Shippers’ Council Maritime Day 2019, Nick Lurkin, of the Royal Association of Netherlands’ Shipowners (KVNR), said carrier customers needed to accept the cap.

“With the IMO regulations there is no delay, even if there are still some that think it will be delayed – it won’t. And as shipowners, we do not want any ...

Maersk u-turn as port congestion increases across Northern Europe

Apple logistics chief Gal Dayan quits to join forwarding group

Maersk Air Cargo sees volumes fall as it aims for 'margin in favour of revenue'

Airlines slash freighter capacity post-de minimis, but 'the worst is yet to come'

Houthis tell Trump they will end attacks on Red Sea shipping

Transpac rates hold firm as capacity is diverted to Asia-Europe lanes

MSC revamps east-west network as alliance strategies on blanking vary

India-Pakistan 'tit-for-tat' cargo ban sparks sudden supply chain shocks

Comment on this article