Hapag-Lloyd won't take bookings if port congestion leaves cargo stranded

A “cautious” Hapag-Lloyd has warned it will not accept bookings if port congestion leaves cargo ...

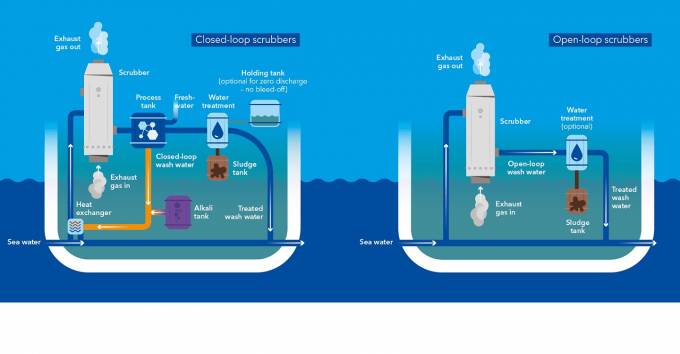

As the price gap between low-sulphur fuel oil (LSFO) and heavy fuel oil (HFO) widens, almost 30% of the global containership fleet capacity is now equipped with scrubber technology, according to an Alphaliner survey.

The consultant said the number of container vessels fitted with scrubbers increased by 150 last year, to 850 ships for 7.52m teu of capacity, with MSC continuing to lead the pack with nearly half its 640-strong fleet able to bunker with the cheaper HFO.

By comparison, Maersk, now ...

Keep our news independent, by supporting The Loadstar

Volume surge and an early peak season? 'Don't celebrate too soon,' warning

Container spot rates diverge: to Europe still falling, but firmer to the US

Hapag-Lloyd won't take bookings if port congestion leaves cargo stranded

Ecommerce likely the front-runner in resurge of transpacific trade after deal

China-US trade tariff pause could drive a rebound for transpacific rates

Service chaos from trade ban with India a problem for Pakistan shippers

Airfreight rates ex-China 'loss-making', but hopes of a trade deal stay high

Shippers should check out the 'small print' in China-US tariff cuts

Carriers impose 'emergency operation' surcharges on Pakistan cargo

Serious threat to jobs in US logistics as tariffs cause economic 'stagflation'

15% rebate for box ships as Suez Canal Authority woos carriers

White House u-turns see freighters flying but keep logistics players on their toes

MSC in terminal switch as Nhava Sheva gets strong start to new fiscal year

Peak season or recession? Forwarders and shippers need to 'stay flexible'

Volga-Dnepr claims 'pirate' Canada has 'hijacked' its stranded aircraft

Comment on this article