Fleet watching is the key to predicting the future in air

All eyes on the aircraft boneyard

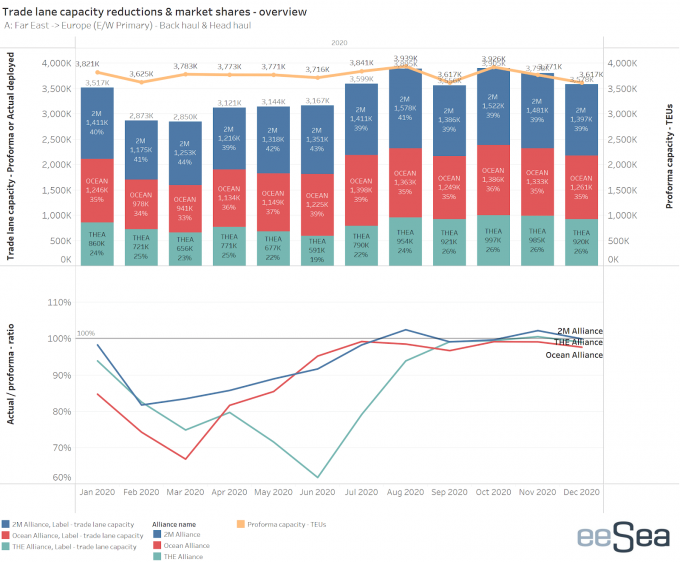

Covid-19 lockdown restrictions on consumers, particularly in Europe and the US, has resulted in a dramatic slump in demand for container space and forced ocean carriers to blank hundreds of sailings.

According to the latest data from Copenhagen-based maritime and supply chain intelligence company eeSea, carriers have so far cancelled 302 headhaul voyages in May across the major tradelanes – 11% of the 2,693 proforma sailings.

That number is likely to increase significantly as carriers assess the full extent of the damage ...

'Disastrous' DSV-Schenker merger would 'disrupt European haulage market'

'Chaos after chaos' coming from de minimis changes and more tariffs

List of blanked transpac sailings grows as trade war heats up and demand cools

Shippers in Asia restart ocean shipment bookings – but not from China

Forto 'sharpens commercial priorities' as it lays off one-third of staff

India withdraws access for Bangladesh transhipments, in 'very harmful' decision

'Tariff hell' leaves industries in limbo – 'not a great environment to plan'

Temporary tariff relief brings on early transpacific peak season

Pre-tariff rush of goods from US to China sees air rates soar, but not for long

De minimis-induced ecommerce demand slump could cripple freighter operators

Asian exporters scramble for ships and boxes to beat 90-day tariff pause

Forwarders 'allowing the fox into the chicken run' by supporting 'hungry' carriers

Hapag 'took the bigger risk' when it signed up to Gemini, says Maersk

'Restoring America's maritime dominance' – stop laughing at the back of the class

Navigating tariffs: 'like trying to solve a Rubik's cube while colour-blind'

Comment on this article