Business calls for end to French port strikes, but unions plan more

French industry body the Mouvement des Entreprises de France (MEDEF) is demanding a swift end ...

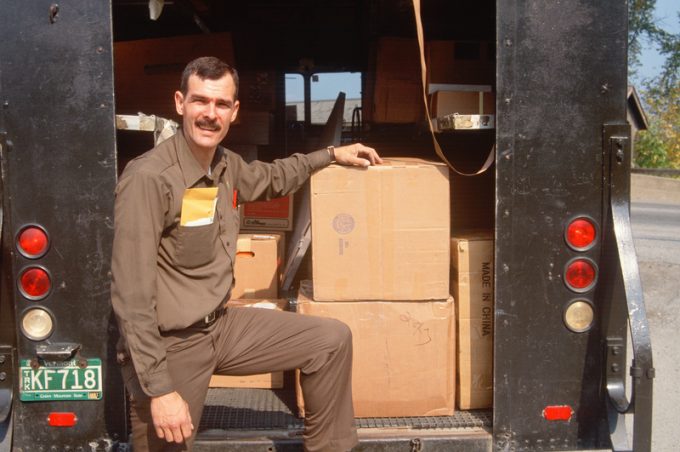

The spectre of a crippling strike is looming larger after the contract talks between UPS and the Teamsters union, which represents some 340,000 of the integrator’s employees, collapsed. In the early hours of Wednesday morning union representatives rejected management’s supposedly final offer as “unacceptable”.

Both sides blamed each other for the breakdown in negotiations. According to the company, the union stopped talks despite a generous offer. A UPS spokesman stated that the union has a responsibility to return to the negotiating ...

Transpacific sees first major MSC blanks as rates fall and volumes falter

'It’s healthy competition' Maersk tells forwarders bidding for same business

Opposition builds for final hearing on US plan to tax Chinese box ship calls

White House confirms automotive tariffs – 'a disaster for the industry'

New price hikes may slow ocean spot rate slide – but for how long?

Shippers snap up airfreight capacity to US ahead of tariff deadline

Supply chain delays expected after earthquake hits Myanmar

Tighter EU import requirements proving 'a challenge' for forwarders

Comment on this article