New senior management for DSV as it readies for DB Schenker takeover

Following its clearance by competition regulators to complete its acquisition of DB Schenker, Danish freight ...

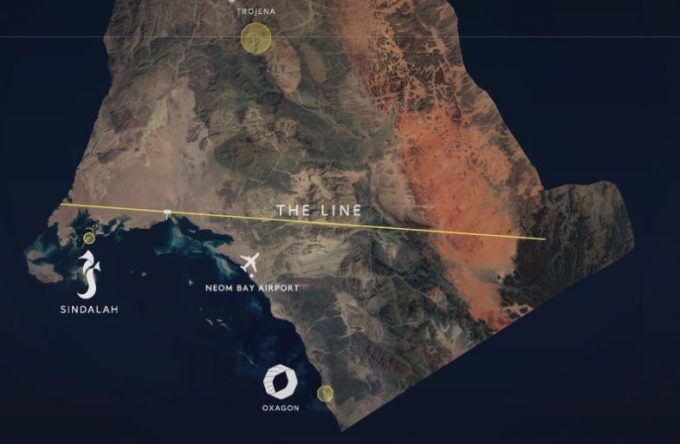

Several Danish investors in DSV have expressed environmental, social and governance (ESG) concerns over the logistics giant’s $10bn joint-venture in Saudi Arabia, supporting the Gulf state’s futuristic Neom mega-city project.

Last month, DSV said that, “under the agreement, the joint-venture will provide end-to-end supply chain management, development and investments in transport and logistics assets and infrastructure, as well as transport and delivery of goods and materials within Neom”.

CEO Jens Bjørn Andersen added: “Neom is one of the largest and most complex projects ...

Maersk u-turn as port congestion increases across Northern Europe

Apple logistics chief Gal Dayan quits to join forwarding group

Maersk Air Cargo sees volumes fall as it aims for 'margin in favour of revenue'

Houthis tell Trump they will end attacks on Red Sea shipping

Transpac rates hold firm as capacity is diverted to Asia-Europe lanes

Airlines slash freighter capacity post-de minimis, but 'the worst is yet to come'

MSC revamps east-west network as alliance strategies on blanking vary

India-Pakistan 'tit-for-tat' cargo ban sparks sudden supply chain shocks

Comment on this article