Finnair Cargo: Santa's preferred carrier happily adapts to a new, if unlevel, playing field

Finland shares a 1,340km border with petulant Russia; it recently joined NATO to help mitigate ...

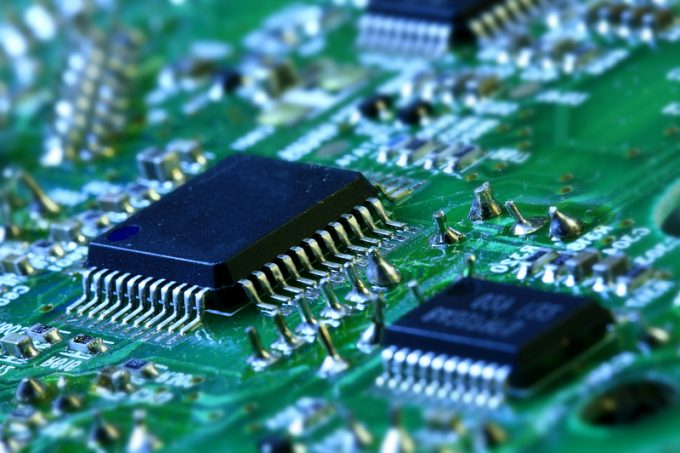

Auto makers are having to pare back production, just as the market is getting back to strength, thanks to a global shortage of semiconductors.

Most major brands have been forced to make cutbacks: Honda’s domestic output is down by 4,000 vehicles; and Nissan has slashed production of its Note by 5,000.

In Germany, Volkswagen and Daimler have reported ship shortages that are forcing them to adjust production, with VW announcing production cuts in Asia, Europe and North America.

In North America, Ford is ...

Maersk u-turn as port congestion increases across Northern Europe

Apple logistics chief Gal Dayan quits to join forwarding group

Maersk Air Cargo sees volumes fall as it aims for 'margin in favour of revenue'

Airlines slash freighter capacity post-de minimis, but 'the worst is yet to come'

Houthis tell Trump they will end attacks on Red Sea shipping

Transpac rates hold firm as capacity is diverted to Asia-Europe lanes

MSC revamps east-west network as alliance strategies on blanking vary

India-Pakistan 'tit-for-tat' cargo ban sparks sudden supply chain shocks

Comment on this article