Cathay Cargo aims for flexibility in bullish Hong Kong airfreight market

Cathay Cargo is committed to being “flexible” this year, in the face of global uncertainty ...

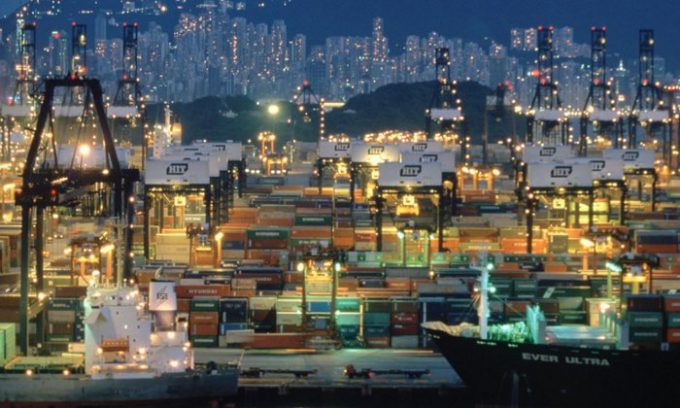

Hong Kong’s status as a major container port hub could suffer a severe blow if mainland China further relaxes cabotage rules.

A new report by respected Hang Seng Management College (HSMC) claims the world’s fifth-largest port could lose as much as 2.4m teu in transhipment traffic or 14% of its throughput, should China’s cabotage rules, allowing foreign-flagged vessels to carry domestic cargo between Chinese ports, be fully relaxed.

Currently, only vessels registered in China or flying the Chinese flag are permitted to conduct ...

Trump tariffs see hundreds of cancelled container bookings a day from Asia

'Disastrous' DSV-Schenker merger would 'disrupt European haulage market'

'To ship or not to ship', the question for US importers amid tariff uncertainty

'Chaos after chaos' coming from de minimis changes and more tariffs

List of blanked transpac sailings grows as trade war heats up and demand cools

EC approves DSV takeover of DB Schenker

Shippers in Asia restart ocean shipment bookings – but not from China

Forto 'sharpens commercial priorities' as it lays off one-third of staff

India withdraws access for Bangladesh transhipments, in 'very harmful' decision

'Tariff hell' leaves industries in limbo – 'not a great environment to plan'

IndiGo fleet expansion plan will include a major push to boost cargo volumes

Pre-tariff rush of goods from US to China sees air rates soar, but not for long

Comment on this article