CMA CGM could build medium-size vessels in US, says Saade

CMA CGM is looking into the possibility of building mid-size vessels in the US, the ...

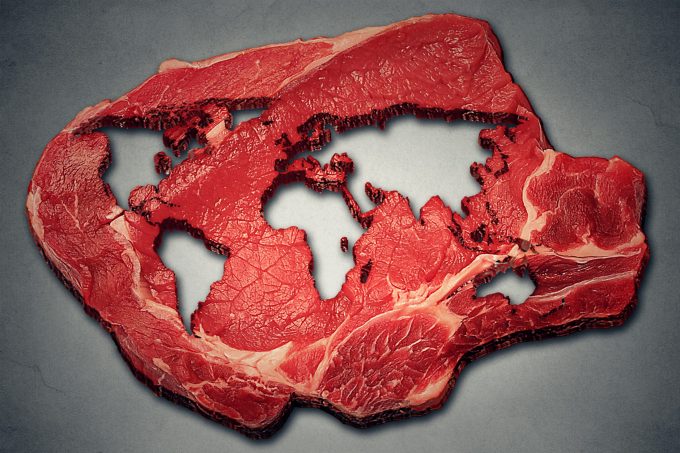

US meat exports are in low gear, affected by bans in the largest market, slowing demand and rising competition from Brazil.

In May, US beef exports were down 0.2% from April and 2.9% year on year, while port exports slumped 10.9% from April to end up 5.7% lower than a year ago.

Still, pork exports were up 6% in the first five months, whereas beef export tonnage dropped 4.9%.

“The market is relatively soft at this point,” said Jean-Paul Weber, SVP sales at ...

MSC port arm to buy Hutchison ports including Panama and Felixstowe

Latest strike will cause ‘massive' disruption at German airports

K+N 'still number-one' in air and ocean – but it's not all good news

US Chinese ship penalties will hit transatlantic trade hardest – Soren Toft

Congestion at Asian and European ports keeping charter rates firm

Liners cut long-haul sailings, but 'it won't be enough' to stop rates tumbling

Comment on this article