News in Brief Podcast | Week 11 | Ocean rates down, uncertainty up

In this episode of The Loadstar’s News in Brief Podcast, host and news reporter Charlotte Goldstone ...

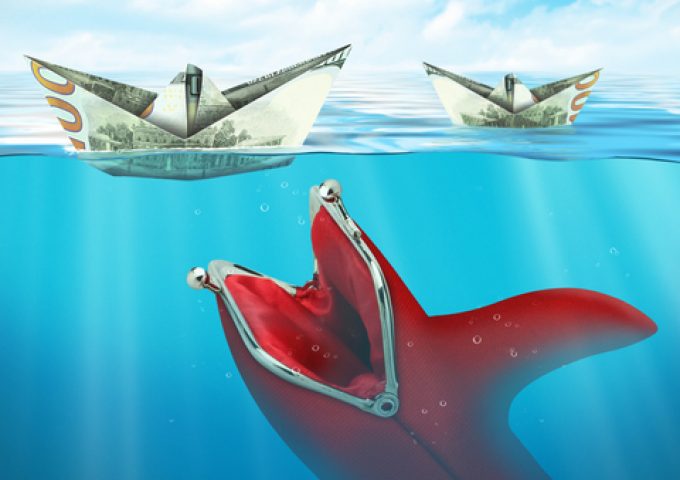

The “mind-boggling profitability” of the container lines has led to industry questions on how they will spend their buckets of cash.

But Randy Giveans, senior VP equity research at Jefferies, revealed to The Loadstar Podcast what one carrier, Zim Lines, is planning to do with its ...

MSC switches two more Asia-Europe port calls from congested Antwerp

CMA airline returns two freighters, while ANA takeover of NCA looms

Front-loading frenzy has made traditional H2 peak season 'unlikely'

Tradelanes: Export boom in Indian sub-continent triggers rise in airfreight rates

Carriers introduce surcharges as congestion builds at African ports

Mexican airport modernisation plan unlikely to boost cargo facilities

Ports and supply chain operators weigh in on funding for CPB

Box ship overcapacity threat from carrier appetite for new tonnage

Comment on this article