Airfreight demand grows but 777F production logjam hobbles capacity

Boeing’s inability to deliver new 777-200 freighters is crimping carrier capacity to meet the strong ...

“The air freight market is really screwed,” one forwarder told The Loadstar this morning.

Carriers – even those with higher rates that typically don’t chase traffic – are begging for volumes at below-market rates, he said.

One air freight statistician noted that, on a weekly basis, the market is “extremely volatile”, in particular over the north Atlantic, with volumes contracting significantly over the past month.

But some weeks have seen double-digit percentage growth over the previous week, only to lose those volumes the following week.

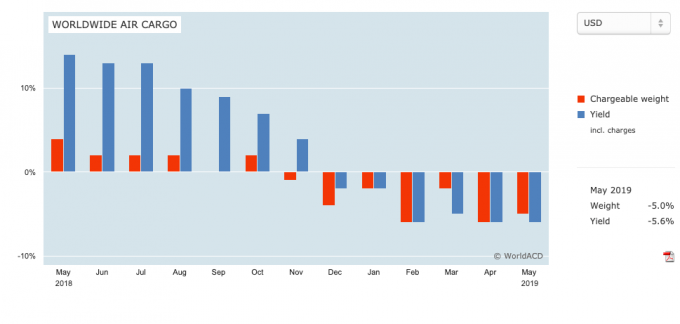

WorldACD reported this morning that May’s results show continuing contraction, with total chargeable weight down 5% year on year, and yields down 5.6% in US dollars; “resulting in revenue loss for the airlines of more than 10% year-on-year”. Monthly, yields were down 2%, to $1.78, but total chargeable weight was 3.9% up on April.

Hi-tech and other ‘vulnerable’ goods rose 5.3% year on year, while pharma and temperature-controlled products were up 9.9% on 2018.

“It is difficult to believe that the year will recover from its dismal start,” noted WorldACD. “[There is] still no recovery in sight.”

It added: “Not a single region escaped the trend: origins Africa and Europe suffered least, with year-on-year volume drops of 2.2% and 2.4% respectively, but origins Asia Pacific and North America chalked up year-on-year losses of 7% and 7.2% respectively. Latin America and Middle East & South Asia (MESA) could not buck the trend either (-4% and -3.4%).”

However, as WorldACD pointed out, there is a more optimistic way of looking at things. A comparison with the strong start seen in 2018 is perhaps unfair – a better comparison might be against 2017.

“Compared with January to May 2017, this year so far shows worldwide growth of 1%. Moreover, 22 of the 40 largest air cargo countries in the world show positive growth for the same period,” it said. “The growth percentages between 2017 and 2019 range from 32.6% for Chile to 0.1% for India.”

There was also growth in Ecuador, Brazil and Colombia, as well as nine countries in Asia & Pacific and five in Europe and North America.

“Ten of these countries also saw growth from 2018 to 2019, of which three scored double-digit: Norway, Pakistan and Vietnam.”

It may be a dismal year so far, but as one cargo executive notes, there is always something around the corner which provides an unexpected boost to air cargo.

Concerns about vessel management in ocean freight towards the end of the year could perhaps be the fillip that is needed.

Shipping lines and forwarders are warning that customers will need to plan ahead, as vessels will need to be taken out of service temporarily in advance of the implementation of IMO 2020 to be fitted for scrubbers and have any remaining heavy fuel oil removed from tanks.

Panalpina suggested the moves would lead to “considerable potential for supply chain disruption” due to “delays in fuel supply, denied port calls and retrofitting” [of scrubbers].

It said the path forward would be “rocky” and shippers should “expect choppy waves”, as well as extra fuel costs from the end of Q3.

iContainers added that the “maritime industry would be left shaken for at least a year following the implementation of the IMO 2020 regulation”.

Any supply chain chaos could, of course, set air freight on a better course towards the end of the year.

Comment on this article