Conf call redux: DSV – 'the logic still applies'

A blast

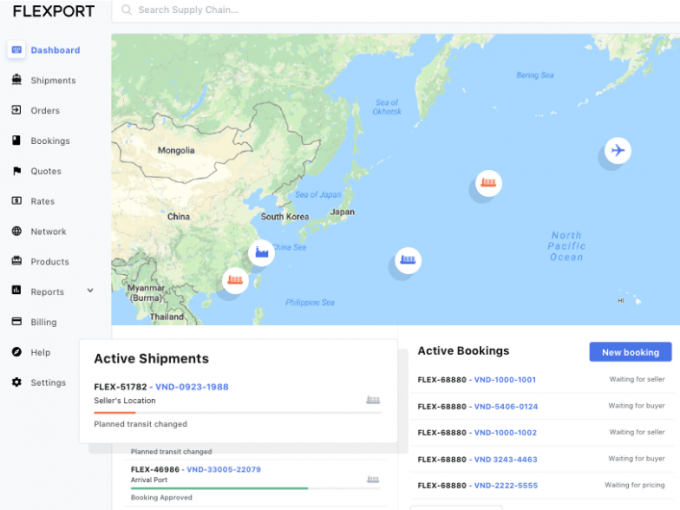

After discussing last week how much Flexport could be worth under three different scenarios for revenue growth, profitability and funding mix, I now find myself in the unenviable position of having to figure out, from the sketchy information the forwarder has sporadically shared, what it could mean for its air and sea freight activities?

How lucky.

Volumes

According to one of its managers, in the fourth quarter Flexport handled much larger sea and air freight volumes – 18,100 teu and 8,250 tonnes, respectively – ...

DSV and K+N see margins squeezed hard in third quarter

Carriers may have 'overshot' on capacity and will need to blank more sailings

Using Amazon Air services 'a win-win' for 'absolutely satisfied' K+N

Freight rates on major ocean trades out of India continue to slide

MSC ship first in line for delays with Montreal dockers set for Sunday strike

Trump second term would pose a 'destructive risk to the container market'

Four arrested in Poland following claims Russia shipped explosive parcels

Comment on this article

Ken Davis

June 08, 2018 at 2:48 pmI think the cold realities of our industry will bite Flexport hard. The money will flow in only so long. The investors will see that the industry is relatively small margins on ocean freight ( even with automation) not near enough volume to warrant a large investment. The idea may be a good one but unfortunately the timing is not right. Automating business will not secure business in the forwarding industry. I would not bet my home on it!

Ale Pasetti

June 08, 2018 at 10:50 pmThank you for your comment, Ken. I do not know if the timing is right or wrong, but I agree thin margins could be a major obstacle for new entrants. Maybe Flexport is right and it will make more profits than the existing players, but we need more evidence, based on its actual performance, to determine if this can continue to be a successful corporate story. As a private company, it might just hide things from the public forever, which is fine, really, but it could do with some help in the way it communicates with the market some key milestones, in my opinion. Best, AP.

Gary Ferrulli

June 08, 2018 at 3:42 pmHype, smoke and mirrors. They send out press releases, people print it without

looking beneath the surface.

Alex Lennane

June 08, 2018 at 4:53 pmIn fact, I don’t think Flexport has ever sent press releases – we certainly haven’t had any…

Marc Whittaker

June 12, 2018 at 10:00 pmWe’ve shifted majority of our volume to Flexport (85k CBM per year; all modes). The prices are competitive with those of the large forwarders, we historically tendered with. It should indicate margin is lower compared to those with large purchasing scale.

Our experience is the level of service we receive is high. A vast improvement above what we have received from top-5 LSPs in the past. The ability to have a single entrypoint globally (especially EXW shipments), great visibility into our supply chain and inventory, reduced need for communication, is differentiating them in the market. They do provide the full cost transparency, we wish any LSP would (and eventually will).

We are not paying a premium for this service today versus the alternatives. We are probably willing to, and while it is hard to put an exact figure to it, would not be more than $100k annually.

There is even a chance margins are slimmer yet. Flexport works directly with our 35+ suppliers across Asia, and does not charge a cost to neither factory or us for the origin service; there overall revenue is thus probably even less, considering the for us otherwise hidden cost.

I agree, they need help with PR and Communication. Some interviews floating around does not reflect well on the company. Comparison with K+N, DSV – be realistic.

Ale Pasetti

June 13, 2018 at 8:50 amAmazing feedback, Marc. Thanks for stopping by.

Just out of curiosity, when you say you are probably willing to pay up, it would “not be more than $100k annually”… $100k annually out of a total FF budget for Flexport of…?

Thanks again, Ale.

John

September 10, 2018 at 3:28 pmGood article.

Something doesn’t add up if you ask me.

Based on 33,000 tonnes of air freight pa and 80,000 TEU of which some will be FEU so let’s say 60,000 sea shipments pa and 700 staff means each person deals with only 1.6 sea shipments per week and (based on an average air shipment size of 500kg for example) just 1.8 air shipments per week. Ironically, they are heavily into tech so don’t need as many staff as legacy forwarders however there will be no other forwarder on this planet employing staff to look after 3.4 shipments per week each. This is just a few hours work for a normal forwarder.

Of course, some people will be employed in non-operational roles but even if half the staff work in sales, admin, tech, etc, then still the ops team only have 7 shipments per week each to deal with which means there isn’t really enough profit to support anything like 350 non ops people which makes me think that most people are actually employed in ops.

With this high ratio of staff to shipment numbers, this company can never make a profit. Maybe they should invest in technology to streamline things. Oh, they already have.

I bet the shorts are looking forward to this IPO!

Ale Pasetti

September 10, 2018 at 4:45 pmGreat feedback, John, much appreciated. The total for FTEs is close to ~ 500, so you might have to slightly tweak your numbers, although the total number of heads including contractors is close to 900, based on what Mr Petersen said two weeks ago — in a rare PR today Flexport talks of “over 1,000 employees”, so I guess this is a moving target but I agree, in principle, that estimates for sea shipments per week are low. I think Flexport is doing a great job, but more disclosure would be good news. Re a possible IPO, it’s still early days, so let’s give it time, as I said in my story. Thanks again for stopping by.