Geodis appoints Laura Ritchey as president and CEO Americas

Geodis has named Laura Ritchey (above) as its new president and chief executive of the ...

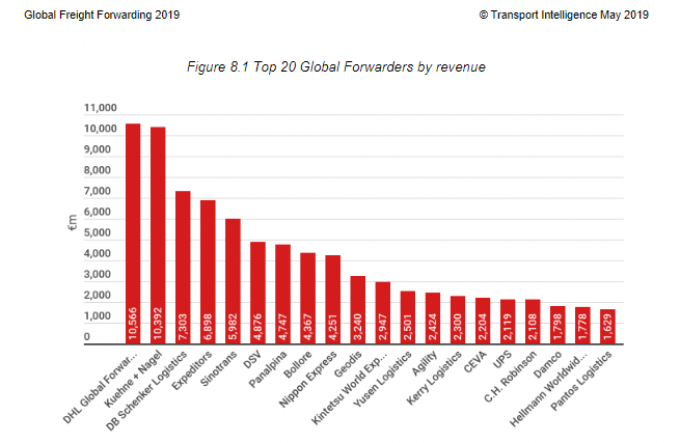

And so the forwarding consolidation chat continues. On Loadstar Premium today, we reveal speculation that CMA CGM, new proud owner of Ceva, is in talks with the French government over the possible acquisition of Geodis.

Geodis has said publicly it is looking for a slice of M&A action – but that it wanted to expand ...

Comment on this article

A.Kout

June 13, 2019 at 2:13 pmWell, will be interesting to see how a DSV can achieve the snyergies they have distributed with the Panalpina merger in a market

where almost every multinational has achieved in the 1 quarter of 2019 a tremendous decrease in available airfreight tonnages of 25-to 30%,

where according to the market, a very intensive fierce competition is going up as almost everyone is selling over price, which in turns does have an fantastic impact on the net profit, so the most forecast we see by the multis are heavily in doubt from our side.

Concentrating too much on general cargo which most Multis still do, is not really the best way of achieving better higher margins. Additionally if you speak with industry shippers, the service quality most Multi´s today render is not in line with their expectations. Standardisation is not really everything, decision makers have to rethink otherwise …..

regards

A.Koût

Anonymous

June 18, 2019 at 8:04 amDachser SE is missing in the stats.

5.6 Billion Euros rev