Airlines slash freighter capacity post-de minimis, but 'the worst is yet to come'

Airlines have already significantly cut freighter capacity since last week’s de minimis change in the ...

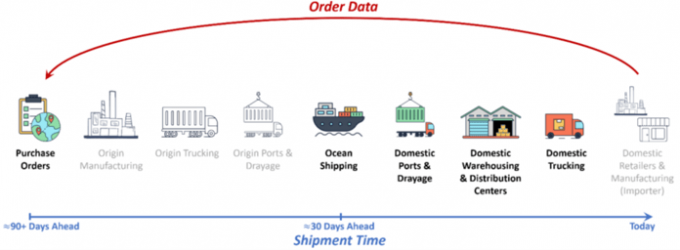

The Freight Logistics Optimisation Works (FLOW) platform, a public-private partnership to share visibility on US containerised imports, has extended inland as the participants look to leverage its insights for their supply chain management and planning.

On Wednesday, the second anniversary of its ...

Comment on this article