Threat of rising oil price adds to frustration for crisis-hit supply chain chiefs

New warnings from the World Bank of surging oil prices, adding to the continuing instability ...

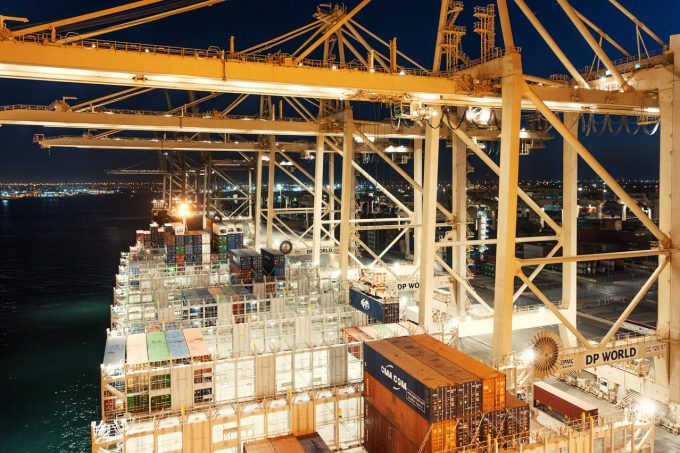

Container carriers – both mainline and feeder operators – have brought in new freight rate tactics for Jebel Ali trade in a bid to hold onto their traditional income from mark-ups or margins on local ancillary collections that have fallen into the crosshairs of UAE regulators.

On 1 November, the UAE’s Dubai Maritime Authority (DMA) abolished the mandate of carriers and other freight intermediaries to settle terminal handling charges (THCs) with terminal operators on behalf of their customers, thus opening a direct payment window for cargo interests.

“All of a sudden, Jebel Ali booking rates from India have moved higher from the negative territory seen in the past few months,” a freight forwarder source in Mumbai told The Loadstar.

Sources note that major lines are quoting $50 per teu and $140 per feu for cargo loads from Nhava Sheva/Mundra to Jebel Ali. But some NVOCCs have lower contract rates, hovering at $25 per teu, according to them. A Unifeeder source put Nhava Sheva/Mundra-Jebel Ali average freight rates at $30 per teu.

By contrast, November carrier contract rates for the India-Jebel Ali leg were in the range of $5 per teu and $15 per feu, with sequential downward corrections reported over the past year as demand weakened and capacity ballooned. Feeder sources also admitted that cargo volumes continued to remain sluggish.

“It’s obvious that the THC mark-ups carriers had held for so long have now been rolled into the base ocean freight,” a forwarder said.

THC rates at Jebel Ali stand at some AED1,250 ($340) per teu for dry cargo, another feeder line executive told The Loadstar. THCs for hazardous export/import loads are typically 50% higher.

Among a wave of local container charges levied by liners, THCs have been the most controversial topic by far, due to wildly varied rates a shipper incurs on the shore side, from terminal to terminal, even within the same port, on top of the line-haul cost.

Following the DMA order, all major carriers made announcements halting their THC collections. MSC said: “The terminal handling charge at the port of Jebel Ali will be collected by the terminal directly from receivers/shippers as per Dubai Maritime Authority directive.

“This direct collection will be implemented for both import and export shipments,” the carrier added.

A couple of years ago, Indian customs authorities, especially at Nhava Sheva Port, also attempted a similar direct THC payment system, but stiff resistance and pushback from carriers, including through legal options, proved it unfruitful.

“The stakes are high for carriers to thwart or bypass regulations,” said an industry observer.

You can contact the writer at [email protected].

Comment on this article