The post-tariff evolution of MSC's transpacific network

Since the shift in alliances earlier this year, Gemini duo Maersk and Hapag-Lloyd have been ...

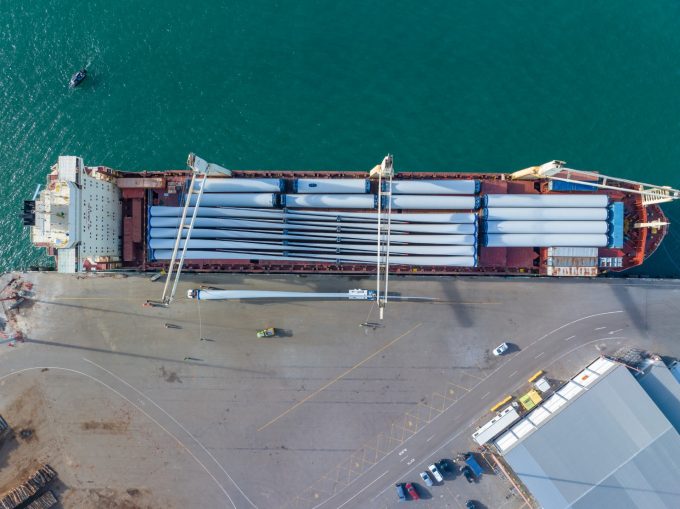

Swire Projects, the heavylift subsidiary of Swire Shipping, has launched a dedicated transpacific semi-liner service that avoids the Panama Canal, after shippers have faced long delays and surcharges in the region.

Low water levels in the canal, caused by a lack of rain, meant the ...

Comment on this article