SNAFU at TOC Europe, but what's this? Positivity sighted!

Amid the gloom

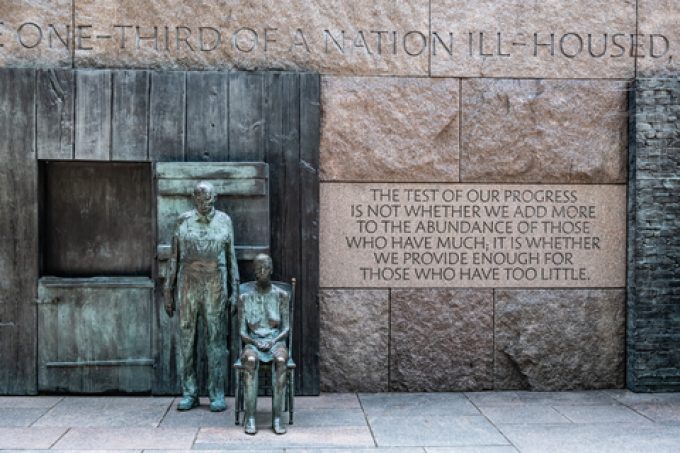

Determined to have his FDR moment, Joe Biden’s latest policy seems likely to have put the frighteners on China, amid what experts are describing as a fundamental reworking of global supply chains and international trade.

Launched on Tuesday, the White House Council on Supply Chain Resilience ...

MSC switches two more Asia-Europe port calls from congested Antwerp

Front-loading frenzy has made traditional H2 peak season 'unlikely'

Tradelanes: Export boom in Indian sub-continent triggers rise in airfreight rates

Carriers introduce surcharges as congestion builds at African ports

Mexican airport modernisation plan unlikely to boost cargo facilities

Canada and Mexico get cosy with trade plan to bypass US

Ports and supply chain operators weigh in on funding for CPB

Tradelanes: Overcapacity on Asia-S America impacting alliances and rates

Comment on this article