Hapag-Lloyd and CMA CGM credit ratings upgraded ahead of 'bumper' Q3

Standard & Poor’s (S&P) have upgraded their credit ratings for ocean carriers Hapag-Lloyd and CMA ...

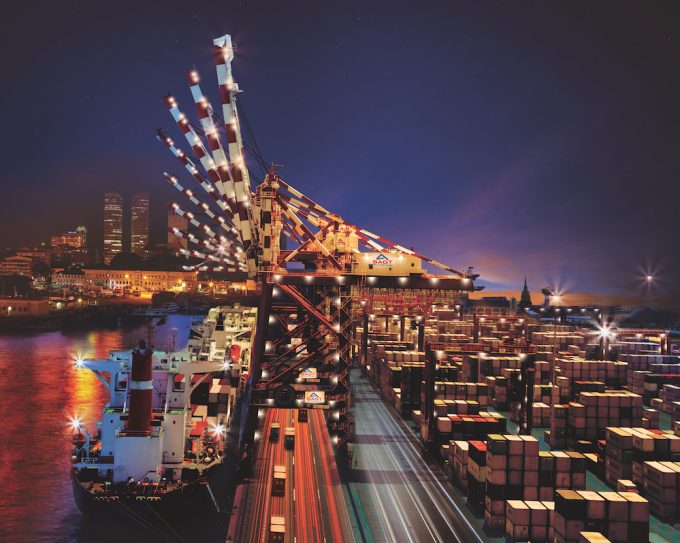

The disruption in Sri Lanka’s Colombo Port is proving a double-edged sword for an Indian container trade already navigating Covid-induced supply chain dysfunction.

According to a report by market researcher CRISIL, the crisis plaguing Colombo – the busiest intermediate port or transhipment hub for Indian cargo – could see some of the mainline services regularly calling shift to other ports in the region.

“Colombo is a major transhipment hub for south Asia, including India, because of its natural locational advantage and competitive ...

Comment on this article