Happy last year in air freight (for some) – and good luck with the next

“Airfreight hasn’t been a bonanza for everybody in 2024,” said Niall van de Wouw, chief ...

FDX: ABOUT USPS PRIVATISATIONFDX: CCO VIEWFDX: LOWER GUIDANCE FDX: DISRUPTING AIR FREIGHTFDX: FOCUS ON KEY VERTICALFDX: LTL OUTLOOKGXO: NEW LOW LINE: NEW LOW FDX: INDUSTRIAL WOESFDX: HEALTH CHECKFDX: TRADING UPDATEWMT: GREEN WOESFDX: FREIGHT BREAK-UPFDX: WAITING FOR THE SPINHON: BREAK-UP ALLUREDSV: BREACHING SUPPORTVW: BOLT-ON DEALAMZN: TOP PICK

FDX: ABOUT USPS PRIVATISATIONFDX: CCO VIEWFDX: LOWER GUIDANCE FDX: DISRUPTING AIR FREIGHTFDX: FOCUS ON KEY VERTICALFDX: LTL OUTLOOKGXO: NEW LOW LINE: NEW LOW FDX: INDUSTRIAL WOESFDX: HEALTH CHECKFDX: TRADING UPDATEWMT: GREEN WOESFDX: FREIGHT BREAK-UPFDX: WAITING FOR THE SPINHON: BREAK-UP ALLUREDSV: BREACHING SUPPORTVW: BOLT-ON DEALAMZN: TOP PICK

The latest air freight data shows a weak market, despite gearing up for peak season, with IATA and WorldACD both describing it as “lacklustre”.

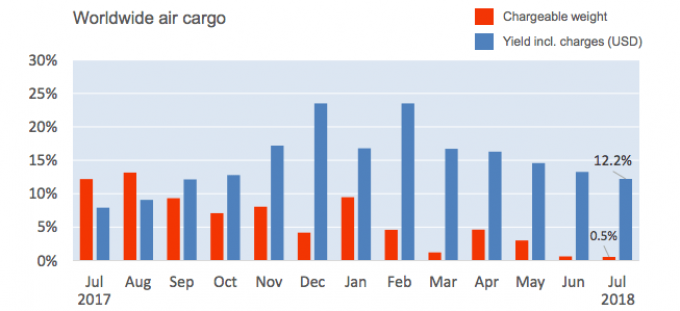

Volume growth for the 31 days of July was virtually flat, with World ACD recording an upturn in tonnage of just 0.5%. For IATA, measured in freight tonne km, recorded growth was 2.1%.

Even so, carriers continued to enjoy significant year-on-year yield growth – up 10.5% – although month-on-month yields dipped 2.2%, according to WorldACD.

“This year, it is 10 years since air cargo had its ‘last hurrah’ before the crisis of 2009,” it said. “Worldwide volume growth in those 10 years was 31% (despite considerable volume drops in 2009, as big as 40%). This figure translates into an average annual growth rate of 2.7%.”

But despite concerns over volume growth, air freight rates remain stronger than a year ago. Panalpina noted that rates remained some 15-20% higher than in 2017.

Global head of air freight Lucas Kuehner added that looking ahead to the peak would not solely be about securing capacity in the air.

“This year, we are not only in close contact with our customers and airlines, but we are also talking to ground handlers and truckers to look at possible bottlenecks,” he said.

“We are even drawing their attention to specific arrival dates and times for incoming cargo from different airlines so they can prepare accordingly. This includes providing tonnages and special handling requirements.”

Despite Panalpina’s confidence, World ACD re-emphasised that July marked the second month in a row with limited year-on-year volume growth. It also noted that distance between origin and destination remained flat.

“When direct tonne km (DTK) grow more than volume, that means that cargo has shifted to longer-haul markets,” explained WorldACD.

“Thus, given the tiny difference of 0.3 percentage points, the average distance between origin and final destination of air cargo shipments in July hardly increased, YoY.

“Actually, the DTK-trend since January 2018 shows that the average distance between origin and destination still grows, but much less so this year than in previous years.”

Figures from IATA show new capacity coming onto the market has outpaced demand. Available freight tonne km grew 3.8% year on year, well up on the 2.1% FTK growth.

Director general Alexandre de Juniac added: “July demand for cargo grew at its slowest pace since 2016, but we still expect 4% growth over the course of the year. However the downside risk has increased. The tariff war and increasingly volatile trade talks between the world’s two largest trading nations are rippling across the economy, putting a drag on business and investor sentiment.

“Trade wars only produce losers.”

Regionally, Africa appeared worst-hit, seeing a decline of some 8% in demand, while other destinations saw growth ranging between 2% and 5%.

IATA suggested the contraction in Africa was indicative of a “softening in demand” but had little to add on what was causing it.

You can read WorldACD’s full report here, and IATA’s here.

Comment on this article