‘Specialty’ air cargo on the up, but traditional 'core' shipments take a dive

The air cargo market has seen a strong decline in what might be termed its ...

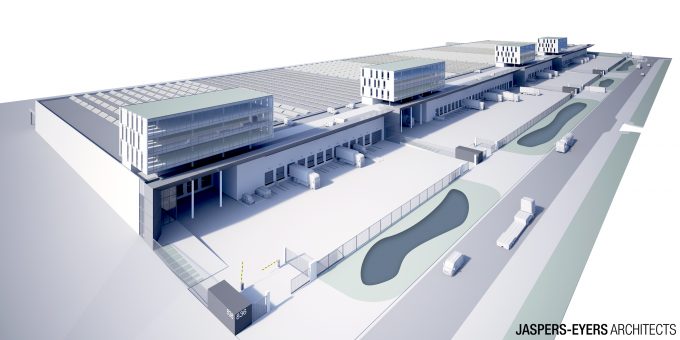

European airports are continuing to record bumper growth, with Brussels Airport Company (BAC) announcing a €100m-investment in new logistics facilities.

News of the investment broke on Friday, with the likes of Dnata, Kuehne + Nagel and Swissport reportedly in line to take space in the facility.

Chief ...

Four crew members still missing as Wan Hai 503 continues to burn

Predatory rivals circle as the ripples from DSV's Schenker buy widen

Explosions and 'out-of-control' fire reported on Wan Hai box ship

MSC Elsa crew face criminal probe, as Wan Hai 503 firefighters battle on

Latest Israeli attack on Iran a threat to box ships in Straits of Hormuz

'It's driving us mad', say forwarders as US court fails to end tariff turmoil

Transpacific rates ease as capacity boost proves too much for trades to digest

Comment on this article