Box volumes are back at Beirut Port – but so is corruption and instability

Three years after the port explosion in Beirut, container shipping has returned to normal – but ...

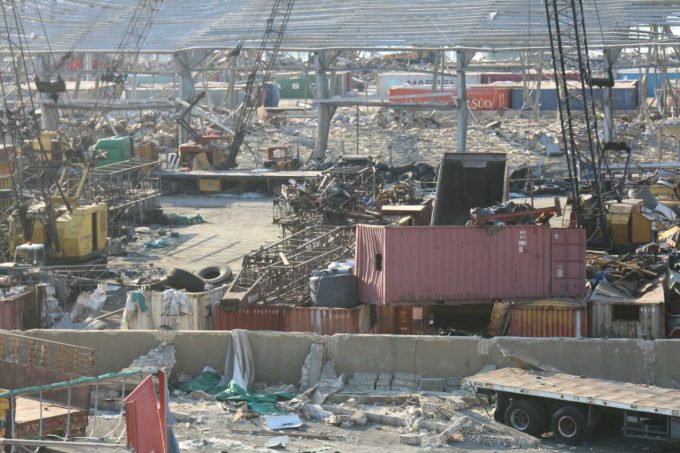

The race to rebuild Beirut port is on, following the devastating explosion at Lebanon’s key cargo gateway this year. According to a World Bank estimate, the damage to the country’s transport sector and port activities ranges between $580m and $710m, on top of reconstruction costs. Now a number of countries are positioning their flagship shipping and ports companies as key potential partners for the project – principally China, France and Turkey, according to this analysis from Global Risk Insights. “They are strategic moves in a geopolitical game for greater influence over the Eastern Mediterranean. As Lebanon is likely to adopt a build, operate and transfer (BOT) scheme to salvage the strategically important infrastructure, this implies that whoever is responsible for its reconstruction will control it and be the main beneficiary of its activities for years to come.”

Etail by air – here to stay or on a short shelf life?

HMM sees opportunities in Hapag-Lloyd’s exit from THE Alliance

The rise and rise of China's ecommerce platforms

Increasing scrutiny could stall rise of ecommerce platforms, as TikTok faces US ban

Legal battle heats up over 'unseaworthy' and 'reckless' MV Dali

DSV chief reticent on Schenker: the focus on growing market share

Another strong month for US ports as container flows continue to rise

MSC redeploys 'Israel-linked' box ships away from Persian Gulf

Alex Lennane

email: [email protected]

mobile: +44 7879 334 389

During August 2023, please contact

Alex Whiteman

email: [email protected]

Alessandro Pasetti

email: [email protected]

mobile: +44 7402 255 512

Comment on this article