With the US and EU putting up barriers, Chinese EVs could divert to SE Asia

Automotive intelligence company Jato has identified a lucrative alternative market for Chinese electric vehicle (EV) ...

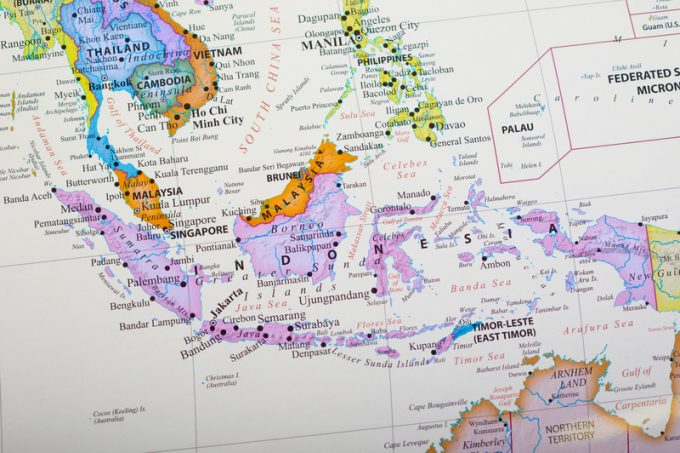

South-east Asia’s container trade with the US is growing faster than China’s, highlighting the region’s shifting sourcing patterns.

According to the Japan Maritime Center (JMC), the share of US container imports originating in Asean broke through 20% for the first time last year – while China’s ...

Comment on this article