Li & Fung weaves its way towards fully digital apparel supply chain with sewbot deal

The era of the digital textile supply chain came a step nearer yesterday after Hong ...

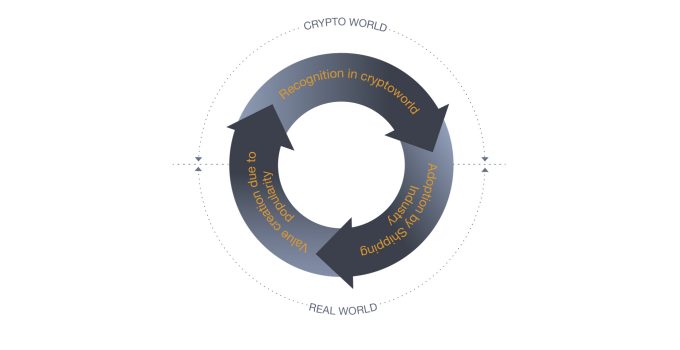

Blockchain initiative 300cubits has created a new type of cryptocurrency to solve liner shipping’s US$23bn “booking shortfall” conundrum.

Named TEU, the de-facto industry currency is distributed as tokens on the Ethereum network and will be tradeable on various global cryptocurrency exchanges.

300cubits claims the tokens will help ...

CMA CGM South Korean staff strike over bonuses after bumper 2024 profit

'Another painful headache for shippers' as Asia-N Europe rate rally ends

Amazon Air Cargo partners-up for new transpacific route into the US

MSC switches two more Asia-Europe port calls from congested Antwerp

Ports and supply chain operators weigh in on funding for CPB

Nightmare for Bangladeshi exporters as congestion and tariffs bite

CMA airline returns two freighters, while ANA takeover of NCA looms

Carriers introduce surcharges as congestion builds at African ports

Comment on this article

dav

August 21, 2017 at 9:28 amgreat idea…industry is in desperate need of exactly…THIS!!!!!!!!

DANIEL Richard JACKSON

August 24, 2017 at 9:27 pm” ……adding that only 100,000,000 tokens would be created to ensure their long-term value.”

All these crypto-currencies have a similar self serving, speculative element….

300cubits is yet another, essentially ponzi scheme, under guise of being

some kind of economic grease-miracle…