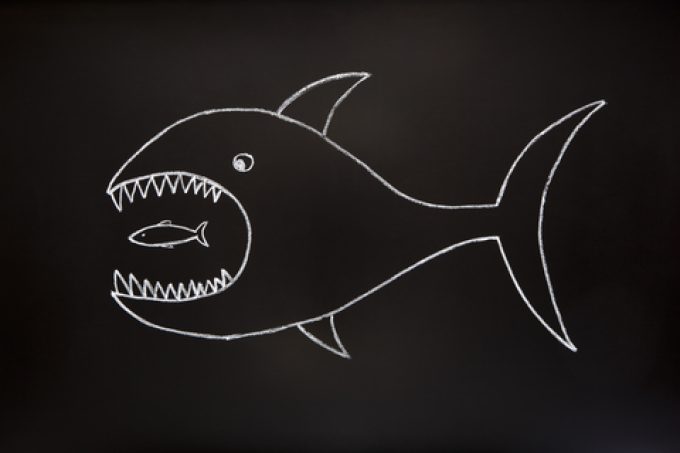

Shipping lines are sub-letting tonnage to profit from firm charter market

Charter rates continue to defy the freight market, with HMM sub-letting a chartered vessel to ...

New data published today by Alphaliner shows the astonishing amount of vessel capacity that has been acquired by shipping lines from non-operating owners (NOOs) since the onset of the pandemic.

Between August 2020 and March 2025, the analysts counted 850 vessels amounting to 3.7m teu capacity were sold by NOOs to carriers seeking to rapidly increase their fleets in response to surging consumer demand during Covid.

“The plunge started in August 2020, when shipping lines, particularly MSC and CMA CGM started raiding ...

CMA CGM South Korean staff strike over bonuses after bumper 2024 profit

'Another painful headache for shippers' as Asia-N Europe rate rally ends

Amazon Air Cargo partners-up for new transpacific route into the US

MSC switches two more Asia-Europe port calls from congested Antwerp

Ports and supply chain operators weigh in on funding for CPB

Nightmare for Bangladeshi exporters as congestion and tariffs bite

CMA airline returns two freighters, while ANA takeover of NCA looms

Carriers introduce surcharges as congestion builds at African ports

Comment on this article

Hans-Henrik Nielsen

April 14, 2025 at 8:25 amInteresting Gavin,

I would like to add a comment to the Inter Asia (where Bangkok max is seen as the backbone).

Whereas this is certainly true for inter south east asia, i feel that we need to start differentiating the north / south trade of North/South East Asia. These trades are quickly becoming “double dip trades” on much larger tonnage trading into Arabian Gulf, Indian Subcontinent, and perhaps even Africa (especially East Africa).