It's all politics: Cosco-backed Peru port project at risk

China’s Peruvian dilemma

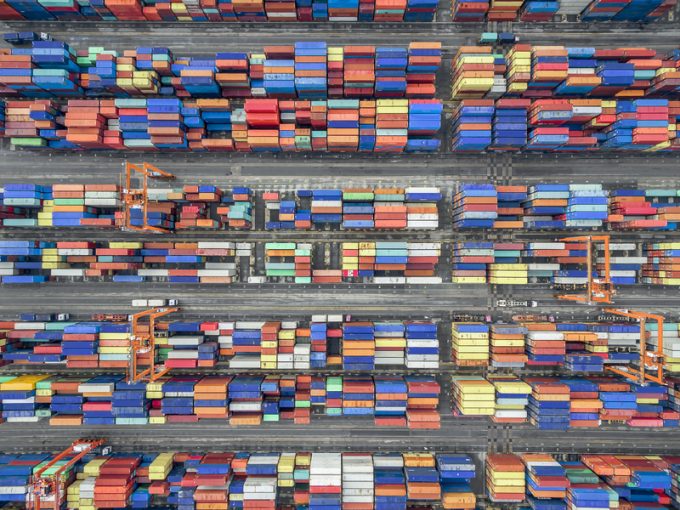

Global terminal operators are profiting from port congestion – surcharges and storage fees are boosting average container yields.

Hutchison Port Holdings Trust (HPHT), which operates a string of terminals across Hong Kong and Shenzhen, saw throughput grow 4% last year, driven largely by the 6% volume growth at Yantian International Container Terminals.

However, the terminal operator’s net profit after tax was HK$3.5bn (US$448.5m), up 75% year on year, down to increased volumes and “effective cost control”, it said.

HPH added: “Global port congestion induced delays in moving containers along the supply chain. Empty containers could not return to Asia ports in time for transporting export cargo to the US and Europe. The shortage of empty containers may exert future pressure on the global supply chain, as manufacturing in China picks up after Chinese New Year.”

And in its annual report, Maersk notes its terminals division enjoyed 11% year-on-year volume growth and increased profitability, with return on invested capital increasing to 10.9%.

APM Terminals (APMT) revenue increased from $3.2bn to $4bn, “driven by higher global demand and increased storage income due to the continued congestion along all nodes in the supply chain, particularly in North America”.

Maersk said the higher “congestion-driven storage revenue” in North America resulted in an increase of 13% in gateway revenue per move to $312.

DP World also announced 2021 volumes this week, showing “ahead-of-industry” growth of 9.4%, to 77.9m teu, and last month PSA International announced 5.6% growth, to 91.5m teu, across its portfolio.

Victor Wai, consultant at Ocean Shipping Consultants, said APMT and HPHT had registered higher average container yield in 2021 “despite a softer throughput growth from Q3 and Q4”.

He told The Loadstar: “The yield enhancement may be contributed to by congestion-related surcharges. We should see some normalisation of the container yield in 2022 as the critical congestion points are addressed.

“The results are solid, in my opinion, because the operating costs rose at a smaller magnitude than revenue, translating into a comfortable cash position. Investors of listed port companies could potentially see a jump in dividend distribution.

“Note though, that DPW is not listed and APMT is just a segment of the APMM listed entity. However, if the results are representative of the sector, we can expect ICTSI, HHLA and Cosco Shipping Ports also to do well.”

In January, OSC noted how the bolstered earnings of container ports and shipping lines would likely trigger further vertical consolidation this year, and an “M&A jostle for supply chain dominance between ports and shipping lines”.

Comment on this article